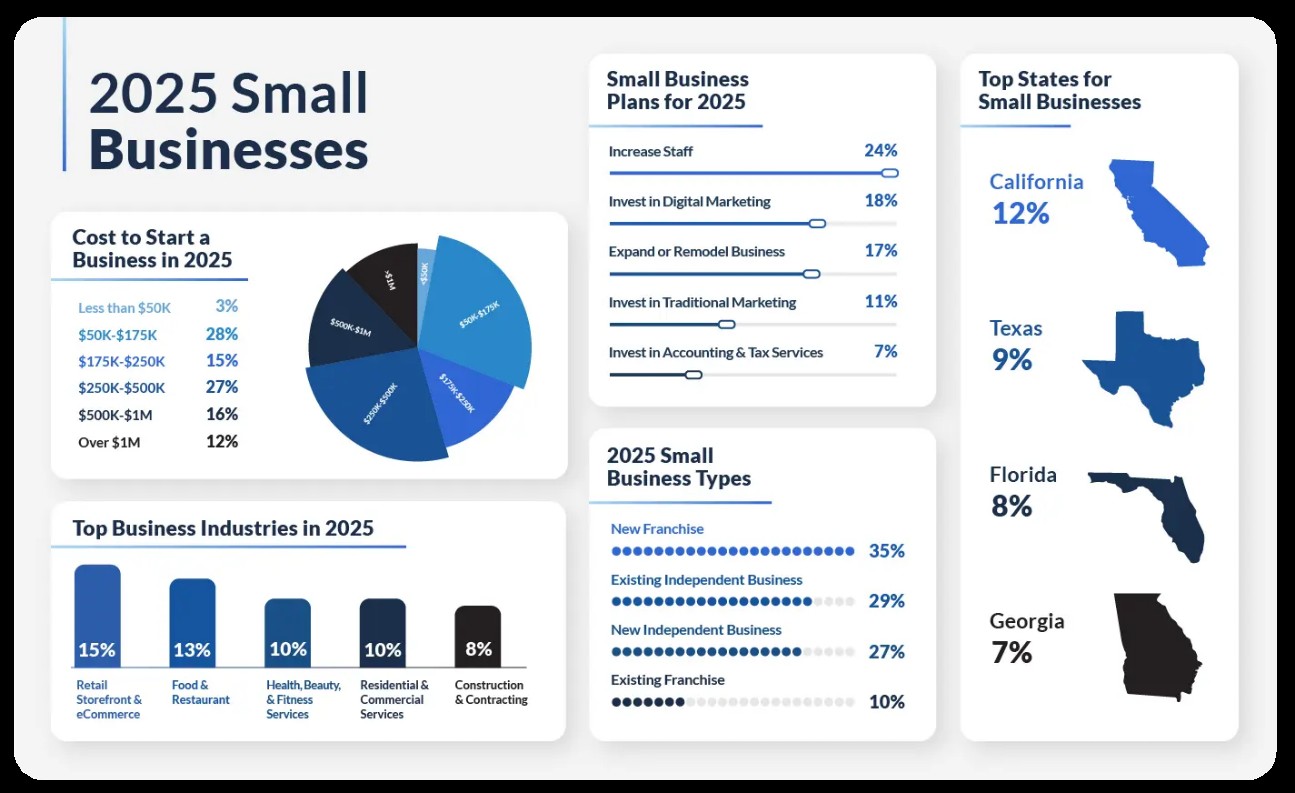

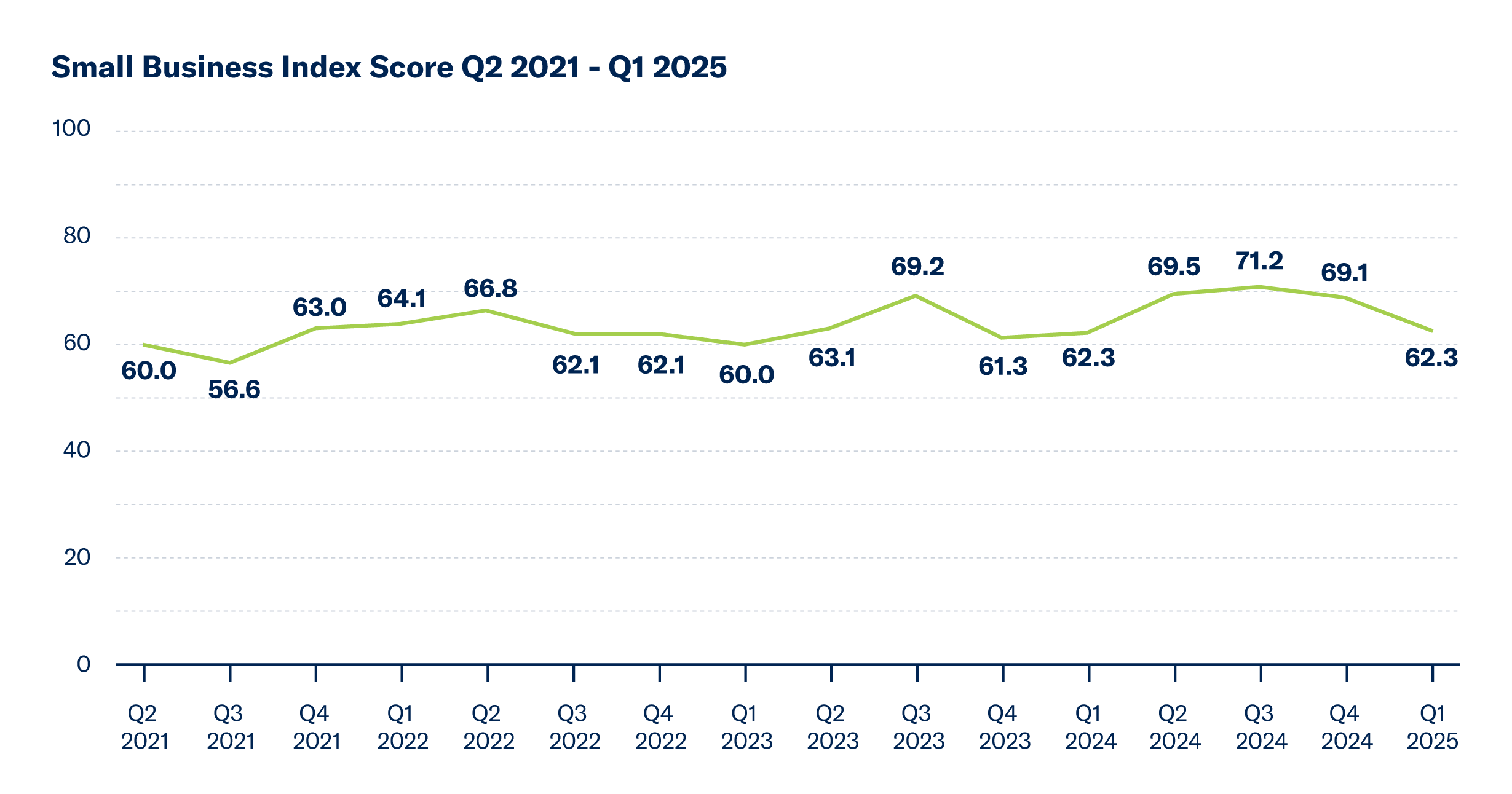

As Q4 2025 ramps up, small and mid-sized business leaders like you are facing intensified pressures. In sectors like professional services, retail, tech startups, and healthcare, the end-of-year push often amplifies cash constraints, especially amid lingering inflation. According to recent insights, nearly six in ten small & mid-size business owners are feeling inflation's sting, with rising costs cited as a major barrier to growth despite overall optimism in the U.S. Small Business Index.

At BizHealth.ai, we serve as your Business Health Coach, providing AI-driven diagnostics to cut through uncertainty and spotlight operational efficiencies. Our platform uncovers blind spots across 12 key areas, including Operations and Financials, helping you affirm strengths and address gaps without the risks of traditional consulting. In this guide, we'll explore small business cash crunch realities, inflation's ops impact, and practical operational cost fixes for 2025. We'll also highlight how efficiency diagnostics can deliver 15-20% gains, turning Q4 challenges into sustainable momentum. Let's transform operational cost fixes and efficiency diagnostics into your roadmap for resilient growth.

Understanding Q4 Cash Crunches in 2025

Q4 often brings a perfect storm for small & mid-size businesses (SMBs): holiday demands spike operations while cash reserves dwindle from year-end taxes, inventory builds, and slower payments. In 2025, this is compounded by economic recovery trends, with the Federal Reserve's interest rates hovering at 4-4.25% and inflation projected to hit 4% by September. Ocrolus and OnDeck's Q2 2025 report shows 92% of SMBs expecting growth, yet cash flow remains a top hurdle for 70% per AP Financing data.

For cash-strapped small businesses, these crunches manifest as delayed vendor payments, stalled expansions, or even payroll strains. In high-density markets like the U.S. (33.3M SMBs), UK (5.45M), and Australia (2.59M), where digital tool adoption is surging 15-30% annually per OECD and McKinsey, owners report uneven inflation effects—hitting variable costs like fuel and supplies hardest. If your business is in early-stage or scaling mode, these blind spots can derail milestones, with 60% stalling post-year three per Gartner.

Recognizing signs early is key: monitor KPIs like EBITDA and CAC for dips, and watch for operational bottlenecks that inflate costs. BizHealth.ai's 30-40 minute questionnaire pinpoints these, offering tailored reports like the Owner's Report to guide quick, data-backed adjustments.

Inflation's Ops Impact on SMB Operations

Inflation isn't just a macro headline—it's reshaping SMB operations in 2025. The U.S. Chamber notes inflation as the primary concern for 46% of small businesses, down slightly but still dominant. Operational hits include:

- Rising Labor Costs: With wages climbing due to regulations and inflation, payroll eats into margins. The rising cost of labor in 2025 adds pressure, forcing owners to balance talent retention with efficiency.

- Supply Chain and Variable Expenses: Fuel, energy, and materials have surged, with operational costs the first to feel the pinch. Inflation drives up inventory and shipping, impacting cash flow for retail and manufacturing SMBs.

- Fixed Cost Pressures: Rent and utilities rise with little warning, fueling layoffs and reduced hours in some cases.

Globally, this varies: In Canada (58% SMB growth), similar regulatory environments amplify compliance costs; in Germany (3.41M SMBs), Mittelstand firms face efficiency challenges in manufacturing. For English-speaking hubs like the UK and Australia, post-pandemic recovery adds volatility, with 90% SME optimism tempered by digital shifts.

The result? Chronic cash squeezes that limit innovation, with 70% of SMBs affected per SBA benchmarks. Yet, this creates opportunities for targeted fixes, leveraging AI to forecast and mitigate.

Practical Operational Cost Fixes for 2025

Tackling small business cash crunch requires actionable, low-risk strategies. Here are proven operational cost fixes for 2025, drawn from efficiency-focused approaches:

1. Streamline Expenses Ruthlessly

Review fixed and variable costs quarterly. Cancel unused subscriptions, renegotiate vendor contracts for bulk discounts, and switch to energy-efficient suppliers—potentially saving 10-15% on overheads, as suggested by Clarify Capital.

2. Automate Where Possible

Implement AI tools for repetitive tasks like invoicing and inventory management. HubSpot's trends show automation yielding 20-25% efficiency gains, freeing cash for growth without adding headcount. Learn more about AI-powered business analytics.

3. Foster a Cost-Conscious Culture

Encourage team input on savings, such as remote work to cut office costs or bulk purchasing. ProcureDesk's 15 tips emphasize automating procurement to lower operating costs by fostering accountability.

4. Optimize Supply Chains

Shift to local suppliers to reduce shipping inflation impacts, or use predictive analytics for just-in-time inventory, minimizing holding costs.

| Fix Strategy | Description | Expected Impact |

|---|---|---|

| Expense Audits | Quarterly reviews of all outflows, prioritizing high-variable items like utilities. | 10-20% reduction in non-essential spend. |

| Automation | Adopt AI for ops like payroll and CRM to cut manual errors. | 15-25% efficiency boost, per Gartner. |

| Vendor Negotiations | Rebid contracts annually, leveraging bulk or long-term deals. | 5-15% savings on supplies and services. |

| Energy Efficiency Upgrades | Invest in LED lighting or smart thermostats for quick ROI. | Lower utility bills by up to 20%. |

| Remote/Hybrid Models | Reduce office space needs amid rising rents. | 10-30% cut in fixed overheads. |

Harnessing Efficiency Diagnostics for Lasting Savings

Efficiency diagnostics are game-changers for cash-strapped SMBs, providing unbiased insights without $10K+ consultant fees. BizHealth.ai excels here: our AI analyzes your 30-minute input to deliver comprehensive reports in under 90 minutes, identifying ops gaps like HR misalignment or risk management lapses that inflate costs.

For instance, if inflation's ops impact shows in your Financials, our diagnostics auto-recommend fixes—like linking to BizGrowth Academy courses for cash flow forecasting. This fosters 30%+ cross-transitions in our Integrated Growth Suite, yielding 20-25x ROI on $99-$299 assessments. Gartner's 2025 trends underscore AI's role in scaling smarter, with diagnostics enabling predictive maintenance to avert costly downtimes.

💡 Pro Tip:

Start small: Use our Employees Report to spot delegation opportunities, reducing overload and enhancing morale. In 2025, with 53% SMB AI adoption per SBA, tools like ours level the playing field against Fortune 500 resources, turning inflation pressures into efficiency levers.

Global Insights: Adapting Fixes Across Markets

While U.S.-focused (80% of our ICP), these strategies resonate globally. In the UK, with 5.45M SMBs and 90% digital adoption, post-Brexit policies amplify cost crunches—use diagnostics for compliance tweaks. Australia's 2.59M SMBs face remote work bottlenecks; automate supply chains for sustainability. Emerging markets like India benefit from broad applicability, targeting consultants for M&A evaluations.

Our universal KPIs (e.g., OKRs, McKinsey 7S) ensure seamless fit, empowering owners in Toronto or Sydney to address cash squeezes affordably.

Conclusion: Stop Guessing, Start Growing

Q4 2025 doesn't have to mean cash crunches—with targeted operational cost fixes, awareness of inflation's ops impact, and efficiency diagnostics, you can sustain growth amid uncertainty. BizHealth.ai cuts the middleman, delivering expeditious insights to uncover 15-20% efficiencies and foster resilient scaling.

Ready to Stop Guessing and Start Growing?

Begin growing your business today with a comprehensive business health assessment. Your growth starts here.

Start My Assessment