Cash Flow Crisis Management: Why 60% of Small Businesses Are Down in 2025—and How to Fix Your Cash Flow Before It's Too Late

In the relentless landscape of 2025, small and mid-sized business (SMB) leaders are grappling with unprecedented financial pressures. Industries like professional services, retail/e-commerce, manufacturing, tech startups, and healthcare are particularly vulnerable, where cash flow management for small businesses has become the make-or-break factor for survival. With inflation lingering and economic uncertainties persisting, around 60% of small businesses struggle with managing their cash flow, leading to stalled growth, payroll strains, and even closures. This isn't just a statistic—it's a reality for busy leaders juggling operations while seeking quick, high-ROI solutions to SMB financial challenges.

At BizHealth.ai, we act as your Business Health Coach, delivering AI-driven diagnostics across 12 key areas like Financials, Operations, and Strategy to eliminate guesswork and uncover efficiencies. Our platform empowers you to turn business cash flow 2025 obstacles into sustainable growth levers, yielding 20-25x ROI on affordable assessments. In this comprehensive guide, we'll dissect the cash flow crisis, explore digital strategies, identify hidden killers, provide a proactive framework, and discuss when to leverage AI tools over traditional experts. Let's shift from crisis mode to confident scaling—stop guessing, start growing.

Understanding Cash Flow: The Lifeblood of Your Business in 2025

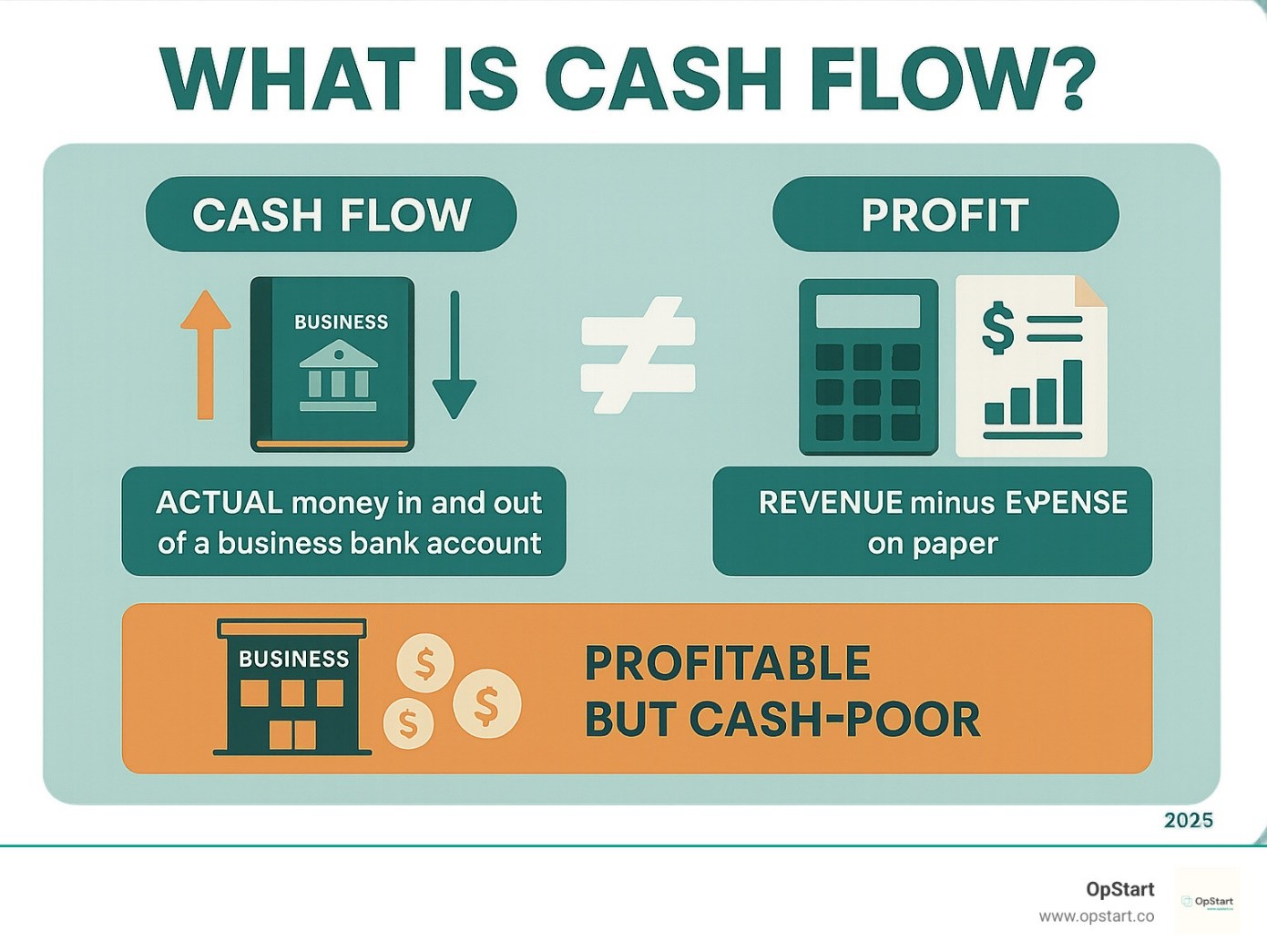

Source: opstart.co

Cash flow represents the actual money moving in and out of your business bank account—not just revenue minus expenses on paper. A profitable business can still be cash-poor if payments are delayed or expenses come due before revenue arrives. This distinction is critical in 2025's high-inflation environment where timing matters more than ever.

The 2025 Cash Flow Reality: Why Traditional Spreadsheet Management Is Failing SMBs

As we navigate 2025, the cash flow reality for SMBs is stark: traditional methods like manual spreadsheets are no longer sufficient amid high-inflation pressures. The U.S. Small Business Administration (SBA) reports that 70% of SMBs face cash flow constraints, exacerbated by inflation as the top macro challenge. In high-inflation environments—where costs for labor, supplies, and energy have surged—spreadsheets fall short because they lack real-time insights and predictive capabilities.

Critical Insight:

82% of business failures stem from poor cash flow management, not lack of profitability. This disconnect is amplified in global markets like the UK (5.45M SMBs with 90% optimism but volatile post-Brexit costs) and Canada (58% growth but regulatory burdens), where English-speaking hubs mirror U.S. challenges.

Why are spreadsheets failing? They rely on historical data, ignoring dynamic factors like delayed payments (affecting 51% of SMBs) or unexpected spikes in supplier costs. In 2025, with B2B SaaS markets hitting $300B and 53% AI adoption for efficiency, SMBs clinging to outdated tools risk margin erosion and liquidity crunches.

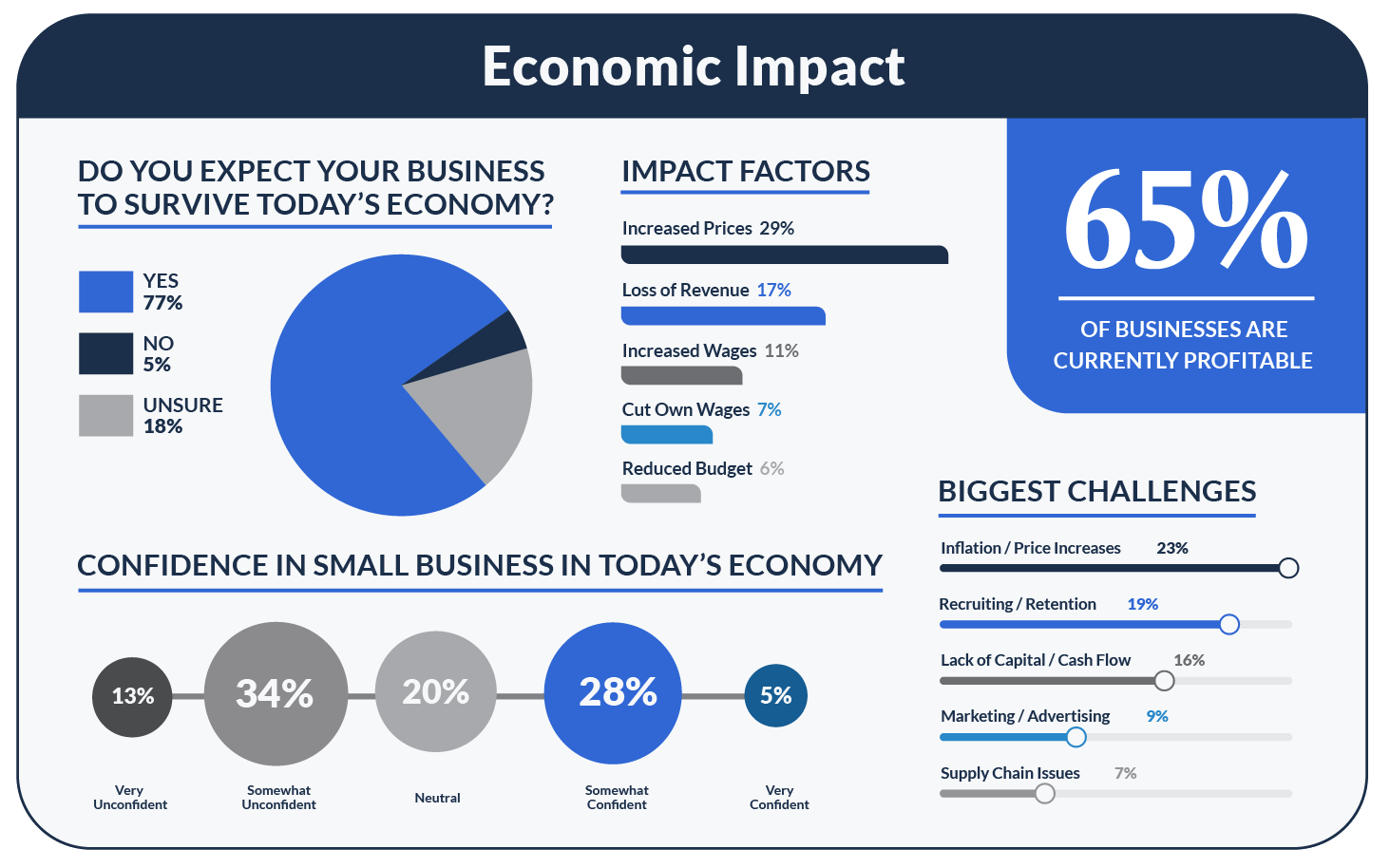

Source: re2.ai - Small Business Statistics 2025

Key 2025 Statistics:

- •77% of businesses are currently profitable, yet many face cash flow pressures

- •23% cite inflation/price increases as their biggest challenge

- •19% struggle with recruiting/retention, impacting operational efficiency

- •9% identify lack of capital/cash flow as a primary obstacle

- •47% feel unconfident or very unconfident about surviving today's economy

Digital Transformation Strategies: How Automation Reduces Billing Errors by 58.7%

Digital transformation is no longer optional—it's essential for mastering business cash flow 2025. Automation tools streamline processes, reducing billing errors by up to 60-80% and accelerating collections, per industry reports. For SMBs, this means shifting from error-prone manual invoicing (which delays payments and ties up capital) to AI-driven systems that flag discrepancies in real-time.

Key Digital Strategies:

1. Automated Invoicing and Reminders

Tools like HubSpot or QuickBooks integrate with CRMs to send invoices instantly, cutting days sales outstanding (DSO) by 30-50%. This addresses late payments, a top cash killer affecting 45% of U.S. SMB owners who forego paychecks due to shortages.

2. Predictive Analytics for Forecasting

AI platforms analyze patterns to predict cash gaps, enabling proactive adjustments. Gartner notes two-thirds of SMBs plan AI investments for efficiency, yielding 15-25% gains.

3. Integrated Payment Gateways

Embed options like Stripe for instant collections, reducing errors and boosting liquidity. In e-commerce, this offsets inventory cash ties and improves working capital management.

Globally, these strategies adapt well: In Singapore (300K+ SMBs with 20-25% efficiency gains via AI), or India (62.5M MSMEs), automation levels the field against inflation. For BizHealth.ai users, our diagnostics auto-recommend solutions from Financials gaps to BizGrowth courses, fostering 30%+ transitions and 20-25x ROI.

The Three Hidden Cash Flow Killers: Late Payments, Rising Costs, and Margin Compression

Source: YouTube.com - 3 Hidden Cash Flow Killers

Amid SMB financial challenges, three hidden killers lurk: late payments, rising supplier costs, and margin compression. These erode liquidity silently, contributing to 82% of business failures.

1. Late Payments

Affecting 51% of SMBs, payment delays create gaps where outflows exceed inflows.

Ask yourself: What's my average DSO?

If over 45 days, you're vulnerable—implement terms like net-30 with penalties to accelerate collections.

2. Rising Supplier Costs

Inflation drives up inputs, squeezing cash. In 2025, 29% cite increased prices as a top impact.

Question: Have I negotiated bulk/long-term deals?

Diversify suppliers to mitigate hikes and protect your margins from input cost volatility.

3. Margin Compression

When costs rise faster than prices, profits vanish. 17% report revenue loss from this squeeze.

Probe: What's my gross margin trend?

Adjust pricing dynamically or trim non-essentials to maintain profitability and cash flow.

Framework for Systematic Cash Flow Assessment: From Reactive to Proactive

Shift to proactive cash flow management with this systematic framework that moves you from firefighting to forecasting:

Source: jaroeducation.com - Top 10 Financial Management Tips

1Assess Current State

Calculate key metrics—cash conversion cycle, DSO, operating cash flow. Use dashboards or AI tools to track performance. Aim for 60-90 day inventory turns to optimize working capital.

2Forecast Future Flows

Use predictive AI for 90-day projections, factoring in seasonality and market trends. Industry data shows 20-25% efficiency uplifts from proper forecasting tools.

3Implement Controls

Automate payment reminders, diversify revenue streams (e.g., add subscriptions), and build cash buffers—target 3-6 months of operating expenses as a safety net.

4Monitor and Adjust

Conduct quarterly reviews and integrate insights with operations for agility. This proactive approach boosts resilience and prevents crisis situations.

When to Seek Expert Help vs. Leveraging AI-Powered Diagnostic Tools

Know when to escalate: If cash crunches persist despite implementing basics, traditional consultants offer deep dives but at $10K+ costs with uncertain outcomes. Instead, leverage AI for unbiased, data-driven insights.

The BizHealth.ai Advantage

Our $99-$299 assessments deliver comprehensive reports in under 90 minutes, addressing SMB financial challenges with actionable insights that drive 15-20% efficiency gains.

- ✓20-25x ROI on affordable assessments

- ✓AI-driven diagnostics across 12 key business areas

- ✓Personalized recommendations with 30%+ success transitions

- ✓Direct links to ecosystem solutions like BizGrowth courses

When to use AI: Routine diagnostics, cash flow analysis, operational efficiency assessments, and strategic planning—areas where data-driven insights excel.

When to seek experts: Complex restructurings, legal matters, major pivots, or situations requiring specialized industry knowledge and hands-on implementation.

Conclusion: Stop Guessing, Start Growing

In 2025, cash flow crises threaten 60% of SMBs, but with digital transformation strategies, identification of hidden killers, and proactive forecasting frameworks, you can not only survive but thrive. The key is moving from reactive firefighting to data-driven decision making.

BizHealth.ai empowers SMB leaders with AI-driven diagnostics that eliminate guesswork and uncover hidden efficiencies. Our platform transforms cash flow obstacles into sustainable growth levers, delivering measurable ROI and actionable insights you can implement today.

Ready to Stop Guessing and Start Growing?

Begin growing your business today with a comprehensive business health assessment. Your growth starts here.

Related Articles

Explore more insights to help grow your business

The Fractional CFO Toolkit: 7 Financial Dashboards Every SMB Needs

Build the financial visibility system that fractional CFOs use to transform small business performance.

Stress-Test Your Pricing: A Framework for Margins and Cash Flow

Learn how to evaluate and optimize your pricing strategy to protect margins and improve cash flow.

Financial Health Metrics Every Business Owner Should Track

Master the key financial indicators that predict business success and sustainability.